One of the earliest contributions to the theory of nature of backwardness and the conditions for growth came from the Polish-born economist Paul Rosenstein Rodan as early as 1943, in the form of an article on the problems of industrialization in Eastern and Southern Europe.

In this article and through later works, Rosenstein-Radon became a prominent spokesman for massive industrial development as the way to growth and progress for the backward areas, both on the European fringe and in the rest of the world. Rosenstein-Rodan expressly distanced himself from neo-classical economics and its static equilibrium analyses, and proposed instead that the growth process must be understood as a series of dissimilar disequilibria.

In a paper from 1957, he expanded this argument further into a theory of the ‘big push’ as a precondition for growth. The background areas were characterised by low incomes and, therefore, little buying powerPower in physics is the rate of doing work; measured in watt... More. Furthermore, they were characterised by high unemployment and underemployment in agriculture. To break out of this mould, it was necessary to industrialise.

However, private companies could not do this on their own, partly because they lacked incentives to invest as long as the markets for their products remained small. The influence of Adam smith’s reasoning was apparent here but Rosenstein Rodan went further with an identification of other growth impeding conditions, including the companies’ difficulties with internalising costs and consequently not being paid for all the goods they produced, for example, the cost of training workers who may then transfer their new skills to other companies.

Rosenstein-Roan claimed that the barriers to growth could be overcome but this required active state involvement in education of the workforce and in the planning and organizing of large-scale investment programmes. And they had to be large scale in order to set a self-perpetuating growth progress in motionMotion is the act of changing location from one place to ano... More, Rosenstein-Rodan compared the ‘big push’ with an aeroplane’s take-off from the runway. There is a critical ground speed which must be passed before a craft can become airborne. A similar condition applied to the growth process: launching a country into self-sustaining growth required a critical mass of simultaneous investments and other initiatives (cf. also Rosenstein-Rodan, 1984).

Ragnar Nurkse took over and further developed many of Rosensteain-Roadan’s major points (Nurke, 1953). Nurke asserted that the economically backward countries were caught in two interconnected vicious poverty circles, which can be illustrated as in the figure.

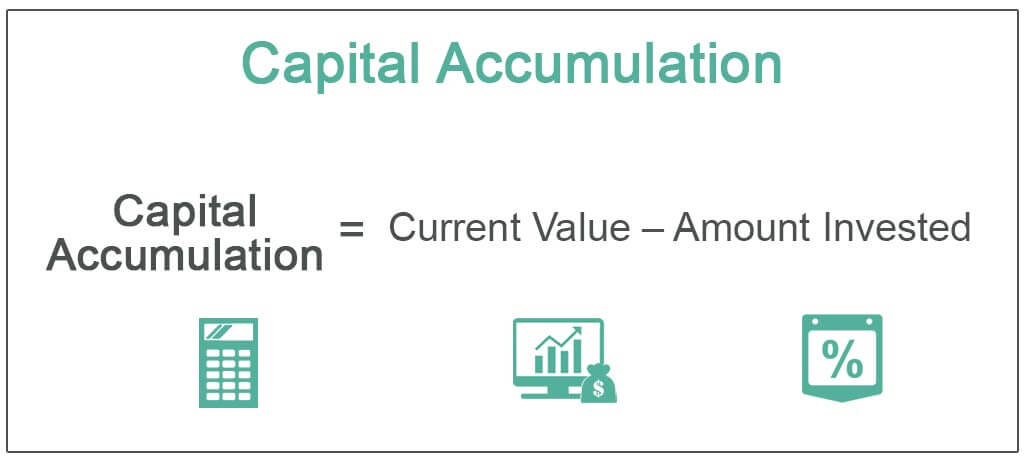

The reasoning behind the circles is that demand in backward countries is low as a consequence of the very low incomes. When demand is low and the market limited, there will not be much incentive to make private investments. Therefore, capital formation and accumulation remain at a very low level. As fore, remain low. On the supply side, the low incomes result in a small productivity. The final outcome is reproduction of mass poverty. Nurkse added to this that the whole problem with attaining the necessary savings and capital investments was compounded by rich people’s tendency to copy, in their own consumption, the consumption standards and patters of the industrially advanced countries. This so-called Duisenberg effect implied an increase in the propensity to consume and thus led to a reduction in the actual rate of saving.

The preconditions for breaking out of these poverty circles were, according to Nurkse, the creation of strong incentive to invest along with increased mobilization of invertible funds. This required a significant expansion of the market through simultaneous massive and balanced capital investments in a number of industrial sectors. This is dependent further on an actively intervening state, which could both plan investment programmes and ensure internal mobilization of resources. The state was important also to bring about optimal utilization of foreign aid, which Nurkse brought in as a critical strategyA strategy is a plan that integrates an organisation's major... More for initiating accumulation of capital on a grand scale.

It is important to note that behind both Rosenstein-Rodin’s and Nurkse’s modes of reasoning there lay a fundamental assumption that an increased supply of goods — as a consequence of capital accumulation — would create its own increased demand. Both theorists imagined that the market would expand as a consequent of increased capital investments which, in turn, would continue to grow in response to market incentives.