This article talks about the different types of strategies that are in use in various organisations for different organisational challenges and to address specific issues. Such challenges and issues border on growth, market share, product development and diversification. Great and difficult challenges such as liquidation, divestiture, retrenchment and joint venture strategies could be applied in critical conditions.

Types of StrategyA strategy is a plan that integrates an organisation's major... More

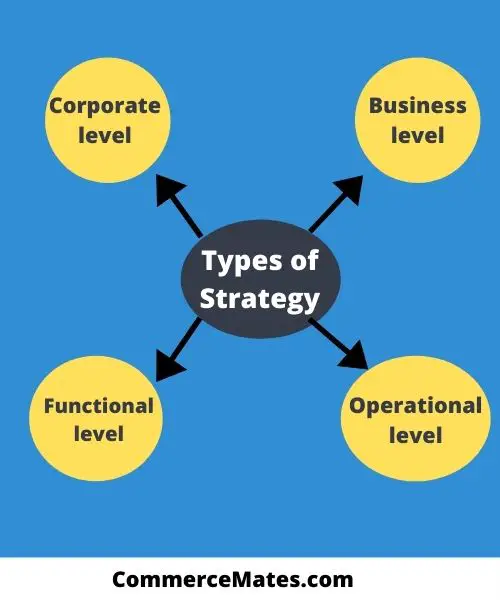

Strategic management and strategy formulation apply to every organisation. In a large organization, there may be a number of interdependent areas of strategyA strategy is a plan that integrates an organisation's major... More. This is conveniently defined as corporate strategyA strategy is a plan that integrates an organisation's major... More for the entire corporate group. It is called business strategyA strategy is a plan that integrates an organisation's major... More for the unit of the group, usually referred to as strategicbusiness unit (SBU) and a functional strategyA strategy is a plan that integrates an organisation's major... More for each part of the single business unit. All these levels must be consistent with one another in order for the entire organisation to be successful.

Corporate StrategyA strategy is a plan that integrates an organisation's major... More

It is the sense of directions for the entire organisation. It identifies the businesses the organisation will engage in and those that it will not. At this level, objectives are globally defined as well as the general orientation for the organisation. The objectives are usually growth, stability or defense (retrenchment). Corporate strategyA strategy is a plan that integrates an organisation's major... More usually provides answers to the question “what business (es) are we in?” It reflects the business strategyA strategy is a plan that integrates an organisation's major... More and in turn, influences the businessstrategyA strategy is a plan that integrates an organisation's major... More, particularly the extent of outsourcing, diversification, scale and scope.

Types of Strategies in Business

Business strategyA strategy is a plan that integrates an organisation's major... More deals with a single SBU, how it copes with the industry environment and successfully contributes to the corporate strategyA strategy is a plan that integrates an organisation's major... More. Business strategyA strategy is a plan that integrates an organisation's major... More by definition should have a definable and identifiable product range, market segment and competitor set. Porter (1985) suggests that business strategyA strategy is a plan that integrates an organisation's major... More is either cost leadership or differentiation of products and may encompass an entire market or be focused upon a particular segment of it. Each SBU has its business strategyA strategy is a plan that integrates an organisation's major... More.

The business strategyA strategy is a plan that integrates an organisation's major... More is the business intent, i.e. the way in which the business wishes to proceed. Many business organisations go too far into the future analysis of their business. They run into problems because the future is not known with that kind of certainty. Therefore, what is needed by the organisation is the broad direction and not details of how to get there. The necessary details are fashioned out by the functional strategies and sub-strategies developed over time.

Functional StrategyA strategy is a plan that integrates an organisation's major... More

There are usually a set of functional strategies for each SBU. Each will aim to make the best use of the resources available in order to contribute to business strategyA strategy is a plan that integrates an organisation's major... More so as to improve performance, functional strategyA strategy is a plan that integrates an organisation's major... More, harness activities, skill and the available resources.

Alternative Strategic Directions

There are numbers of strategic directions which an organisation may pursue. These possible development strategies are shown in Fig. 10 in which seven alternatives are suggested based upon the extent to which new markets or new products are sought (Ansoff, 1968). In this model, the seventh alternative which is diversification may be split into related and unrelated business areas.

– Do nothing – Withdrawal – Consolidation | – Product development |

– Market penetration | |

– Market development | Diversification – Related – Unrelated |

On existing on new

Do Nothing

This is strategyA strategy is a plan that integrates an organisation's major... More that ensures the continuation of the existing direction, i.e. tends to maintain the status quo. On the long-term, it may not be beneficial but as a short-term approach it may be appropriate. Some growth may occur if the current market grows otherwise the resource levels and other things will remain constant.

Withdrawal

Using this strategyA strategy is a plan that integrates an organisation's major... More, the organisation has to remove itself from the industry due to an irreversible decline in demand, adverse competitive pressure and environmental changes or opportunity cost that indicates other business activities after a more appropriate strategic direction. It is a strategyA strategy is a plan that integrates an organisation's major... More of assets realisation and resources deployment.

Consolidation

This occurs when a dominant industry organisation aims at stability in order to accumulate cash reserves for future activities. Consolidation is achieved by cutting down costs and/or increase prices with the aim of obtaining better margin. It is strictly followed to maintain the current market share. A similar strategyA strategy is a plan that integrates an organisation's major... More with the intention to reduce the scale of operation is called retrenchment.

Integration Strategies

These are the forward, backward and horizontal integration strategies. They are sometimes collectively called vertical integration strategies.

These strategies allow the firms to gain control over distributors, suppliers or competitions.

Forward Integration

This involves gaining ownership or increased control over distributors or retailers.

Backward Integration

This is a strategyA strategy is a plan that integrates an organisation's major... More for seeking ownership or increased control of a firm’s suppliers. The strategyA strategy is a plan that integrates an organisation's major... More is appropriate when a company’s current suppliers are unreliable, costly or cannot meet the company’s demand. Some firms use backward integration to gain control over suppliers but some companies instead owe their suppliers and negotiate with several outside suppliers.

Horizontal Integration

It refers to a strategyA strategy is a plan that integrates an organisation's major... More of seeking ownership of or increased control over a firm’s competitors. This is the most significant trend in strategic management of today. It is a growth strategyA strategy is a plan that integrates an organisation's major... More. Mergers, acquisitions

and take-overs among competitors allow for increased economies of scale and enhance transfer of resources and competencies.

Intensive Strategies

Market penetration, market development and product development are referred to as “intensive strategies”. This is because they require intensive efforts to improve a firm’s competitive position with existing products.

Market Penetration

This seeks to increase market share for present products or services in present markets through greater marketing efforts. It involves increasing the number of sales persons, advertising expenditures, offering extensive sales promotion items and increasing publicity efforts.

Market Development

This involves the introduction present products or services into new geographical areas. Many domestic firms are striving hard to carry their products abroad. Expansion into the world market is however, no guarantee for success. It is more important to allow greater care in quality control and consumer services.

Diversification Strategies

Generally, there are three types of diversification strategies, namely, concentric, horizontal and conglomerate. Diversification strategies are becoming less popular. This is because organisations are finding it more and to manage diverse business activities.Peters and Waterman”sadvice to firms is to stick to the knitting and not to stray too far from the firm’s basic area of competence.

However, diversification is still an appropriate and successful strategyA strategy is a plan that integrates an organisation's major... More. For a company like Philip Morris diversification makes sense because cigarette consumption is declining, product liability suits are a risk and some investors reject tobacco stock on principle.

Concentric Diversification

An example is the New Zambia Newspapers going into exercise book production. The two products have both marketing and technological energyEnergy is the property of matter and radiation which is mani... More but may not have the same set of customers.

Horizontal Diversification

This strategy’s is not as risky as the conglomerate diversification because the firm should be familiar with its present customers, e.g. New Zambian Newspaper Company going into property development and house building. These two products have neither marketing nor technological synergy but may have the same set of customers.

The strategyA strategy is a plan that integrates an organisation's major... More entails adding new unrelated products or services.

Conglomerate diversification is practised partly in expectation of profit from breaking up acquired firms and selling divisions piecemeal. This means that the company’s assets are worth more separately than when they are together. There is a kind of anti-synergy, the whole being worth less than the units.

Defensive Strategies

Joint Ventures

This is a strategyA strategy is a plan that integrates an organisation's major... More that occurs when two or more companies form a temporary partnership or a consortium for the purpose of capitalizing on some opportunities. It is considered defensive because the firm is notundertaking the project alone. Two or more firms may have shared equity ownership in the new entity. Other corporate arrangements include research and development partnership, cross-distribution agreements, cross-licensing agreements, cross-manufacturing agreements and joint bidding consortia. Joint ventures and co-operative arrangements are being used because they improve company communications, networking and minimize risk. Cooperativearrangements even between competitors are on the increase.

Retrenchment

This strategyA strategy is a plan that integrates an organisation's major... More occurs when an organisation regroups through cost and assets reduction to reverse declining sales and projects. It is sometimes called turnaround or re-organisational strategyA strategy is a plan that integrates an organisation's major... More. Retrenchment canentail selling off land and building to raise the needed cash, pruning product line, closing obsolete factories or marginal business, reducing the number of employees and instituting expenses control system. In some case, bankruptcy can be an effective type of retrenchment strategyA strategy is a plan that integrates an organisation's major... More.

Bankruptcy can allow a firm to avoid major debts obligations and to avoid union contracts. Bankruptcy is a liquidation used only when a company sees no hope of being able to operate successfully or to obtain necessary creditor agreement.

Divestiture

This is a strategyA strategy is a plan that integrates an organisation's major... More involving the sale of a division or part of an organisation. It could be part of an overall retrenchment strategyA strategy is a plan that integrates an organisation's major... More to rid an organisation of businesses that are unprofitable, that require too much capital or that do not fit well with the firms other activities.

Liquidation

Liquidation is a strategyA strategy is a plan that integrates an organisation's major... More that involves selling all of a company”s assets or in parts, for their tangible worth. Liquidation is a recognition of defeat and consequently can be an emotionally difficult strategyA strategy is a plan that integrates an organisation's major... More.

However, it may be better to ease operating than to continue losing large sums of money.

Combination of Strategies

Many organisations pursue a combination of two or more strategies simultaneously. However, no one organisation can afford to pursue all the strategies that will benefit the firm because organization, like individuals, has limited resources; difficult decisions must be made and priorities must be established.

Therefore, organisations must choose among alternative strategies. In large diversified companies, a combination strategyA strategy is a plan that integrates an organisation's major... More is used when different divisions pursue different strategies. Similarly, organisations struggling to survive may use a combination of several defensive strategies such as divestiture, liquidation and retrenchmentsimultaneously.

Requirements for Developing Effective Strategies

Alternative strategies are derived from the firm”s mission, objectives, external and internal audits. They are consistent with or built upon, past strategies that have worked well. There are many methods of developing effective strategies. The requirements may involve:

A Routine Method

This involves looking at what the company has been doing in the past. Caution must however; be exercised in adopting this technique since the new challenge or problem may be a break away from the past.

Creativity

As a strategist, you may attempt to conceptualise a scenario of the organisation and try to develop effective strategyA strategy is a plan that integrates an organisation's major... More.

Brainstorming

Developing effective strategies may also require putting together many experts for a number of days for brainstorming.

Consultant Services

Many managers now employ the services of consultants for developing effective company strategies.

Holistic Approach

Strategic planning should be initiated by a company”s top management because of the broad perspective of these executives. The strategic process works from general to specific. This is called holistic approach to strategic planning.

Tactical Approach

Some researchers believe that the holistic approach is inferior to a tactical approach in certain circumstances. With the tactical approach, strategic managers workWork is The transfer of energy from one physical system to a... More up through the firm in their study of its potential. Strategic management process must be a people process for it to be successful. Through the involvement in the process, the managers and employees become committed to supporting the organisation.

Dialogue and participation are also essential ingredients.

Informed Employees

Fundamental to effective strategyA strategy is a plan that integrates an organisation's major... More development are fully informed employees at all levels in the organisation. Every employee must beinformed of business objectives, the process of achieving the objectives, customers, competitors and product plans.

Global Factors

Global factors must be considered in developing effective strategyA strategy is a plan that integrates an organisation's major... More. The boundaries of countries can no longer define the limits of people”s imaginations. To see the world from the perspective of others has become a matter of survival for business. The price and quality of a firm”s product must be competitive on a worldwide basis not just on a local basis.

Based on past experience, judgment and feelings, intuition is essential to making good strategic decisions. Intuition must be integrated with analysis in decision making. This is because analytical thinking and intuitive thinking complement each other. Operating from the “I have already made up my mind, don”t bother me with the facts made”, is not management by intuition; it is management by ignorance.